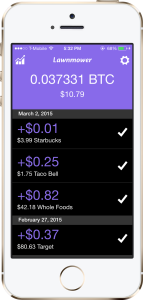

Recently I downloaded Lawnmower, a bitcoin app that turns the “spare change” from your credit card purchases into bitcoin. So, for every $3.60 you spend at McPoundtown, Lawnmower puts $0.40 towards an investment in bitcoin. Here is how my experience with the app has gone so far (about 10 days.)

Let’s start out by saying that I can’t save money. I may be the only person in the entire world that has used a CoinStar since the early 2000’s. Give me four quarters and I will give you the wrapper of the Twix that I just ate. Thus, I am constantly looking for the most pain-free way to save.

Unfortunately, my erratic spending is at odds with my chosen lifestyle as a bitcoin hobbyist. I have written about the legality of virtual currencies and commented on model regulations for bitcoin BUT I am still in my 20’s and actually saving the money to buy a full bitcoin is about the hardest thing I have done since I tried to stay sober at a networking event.

When I read about Lawnmower in Fortune I was skeptical for three major reasons. First, I generally don’t trust bitcoin businesses because exactly one third of all bitcoin users are certifiably insane. Second, I knew that using it would require me to link my bank account to the app somehow, which I didn’t love. Finally, I read the app was still in beta and I haven’t trusted a Beta since my first semester at the University of Oklahoma (am I right ladieees?). Still, I am a sucker for a savings account and I decided to investigate further.

Pro tip: the best place to start investigating a bitcoin business is their “Legal” section. You may not know this, but by using A LOT of bitcoin businesses you are tacitly agreeing to be governed by the laws of a different country. (#teamSingapore).

Lawnmower’s legal info seemed to be on the up-and-up. Most of their Terms of Use are somehow related to those of Coinbase, to which I have already agreed. The price is based on Coinbase’s valuation, purchases from Coinbase count towards the transactions, and the privacy policy is virtually identical to that of Coinbase. Essentially, Coinbase looked at me and said, “Don’t worry girl, he’s with me.”

Next I looked into how it worked. It is exactly as easy as it sounds. You download the app, it links with your Coinbase account, you spend like crazy, it rounds up to the next dollar, and you eventually you get a bunch of bitcoin. Lawnmower holds off on buying you any bitcoin until you have saved up $4.

Seems legit.

So I downloaded the free app and waited for the bitcoin to roll in. I was asked if I would like it to jumpstart my savings by applying it to some of my most recent purchases. Globviously I said yes; I desperately wanted to see what was going to happen. For a day or two nothing happened. I looked at my Coinbase wallet and it said I had a very sexy $0 worth of bitcoin. About three days later I glanced at my Coinbase and BOOM, new wallet. The wallet simply called “Lawnmower” had just under $4 worth of bitcoin (classic price fluctuations.)

It took about eight purchases worth of change to buy my first .02 of bitcoin through Lawnmower but it was pretty exciting. So far I am up to about $18 worth of bitcoin all just from saving my “spare change.” Once I actually started paying attention to the purchases I started wanting more bitcoin. I got super pissed off that it wasn’t buying as fast as I can spend but apparently it can only buy as fast as Bank of America processes payments.

As it turns out, I’m a fan. I’d definitely tell people to use it. It works with most of the major banks so some people that have local banks may not be able to use it (sorry Grandma, Five Thirds didn’t make the cut this time.) Bonus: You can send and receive money with your Lawnmower wallet just like you could any other Coinbase wallet. This was a welcomed surprise I discovered when I needed to send someone .001 bitcoin and I somehow couldn’t rationalize spending $0.23 to buy that off the exchange.

One thing I was not prepared for is that it does take a full dollar if your purchase is for an even dollar amount. (ex: you spend $5.00 and Lawnmower puts $1.00 towards bitcoin.) I didn’t love that at first but honestly I don’t hate it. Also, it has made me more conscious of how often I buy something from the vending machine or take Sidecar.

Moral of the story is I give them a round of applause. I can’t wait to save up enough bitcoin so that I can blow my savings on something completely useless from O.co.

S&F